Materiality and Dialogue

CaixaBank Asset Management, aligned with CaixaBank Group, carried out its first materiality study in 2023.

This study is a tool that allows the company to analyse the impact of the main strategic sustainability issues on , both business development and the relationship with key stakeholders.

The methodology carries out an in-depth analysis of the company and its environment, with an exhaustive identification of material issues and a prioritisation with the participation of senior management, a working group, key stakeholders and internal and external experts.

The results of the materiality study are a key source of information for the implementation of the strategy in the coming years.

The materiality study consisted of three phases.

In the first phase, material issues were identified based on the analysis of 113 internal and external sources on CaixaBank Asset Management, CaixaBank Group, the sector and the sustainability context, and interviews with stakeholder representatives and experts.

This first phase resulted in a list of 15 material issues that were prioritised in the second phase through more than 400 consultations , which determined the impact of the issues on the business or on stakeholders, depending on their relationship with the management company.

Learn about the phases of the materiality study

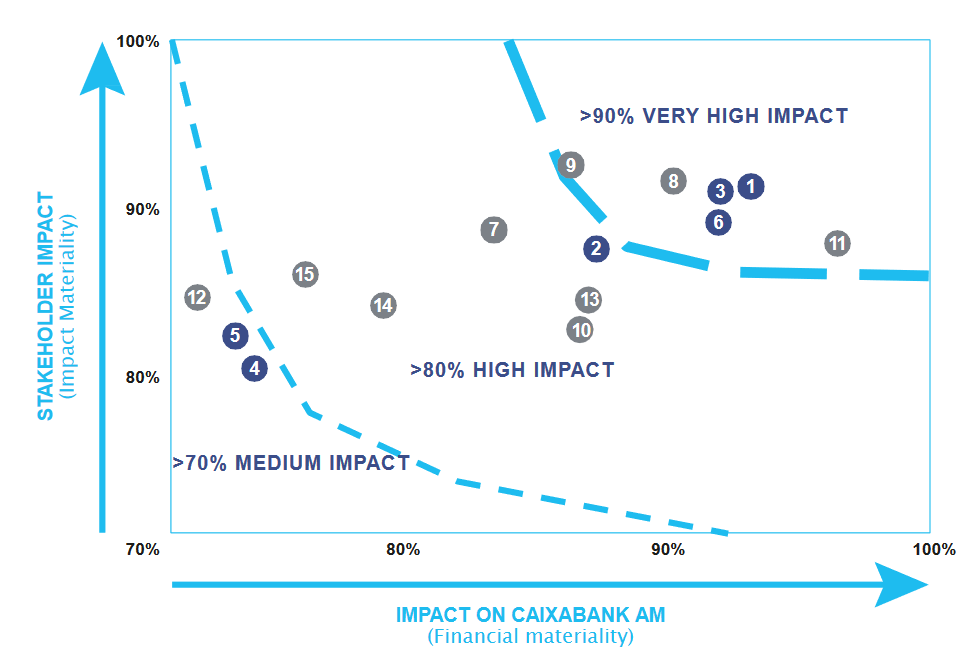

The results of the study are consolidated in a materiality matrix consisting of two axes:

- Impact on stakeholders: impact of the issues on the relationship between CaixaBank AM's stakeholders and the management company.

- Impact on business: impact of the issues on the management company's activity, understood as the capacity to implement its strategic lines AND achieve its objectives.

The assessments of both axes are constructed on the basis of two outcomes: Prioritisation of material issues (current vision), selection of the issues that will have the greatest impact in the next 5 years (future vision).

The material topics are distributed in the matrix into three impact levels, which are defined on the basis of low and high scores. Therefore, the axes of the matrix represent ratings between 70% and 100%.